The Gold Price War LIVE Debate

Watch the compelling, intriguing, insightful and most polarizing presentation on the future of gold and precious metals by two household names in the finance industry…

If you’re going to invest in precious metals this year, wait until you watch the debate that could dramatically impact your future wealth

LIVE Virtual Event

ONLINE EVENTYou will be sent an email with the access link after you register!

Thursday, February 25th 11am AEDT (Sydney)

Wednesday, February 24th 7pm EST (New York)

Time left until registration closes:

Shortcode could not be rendered

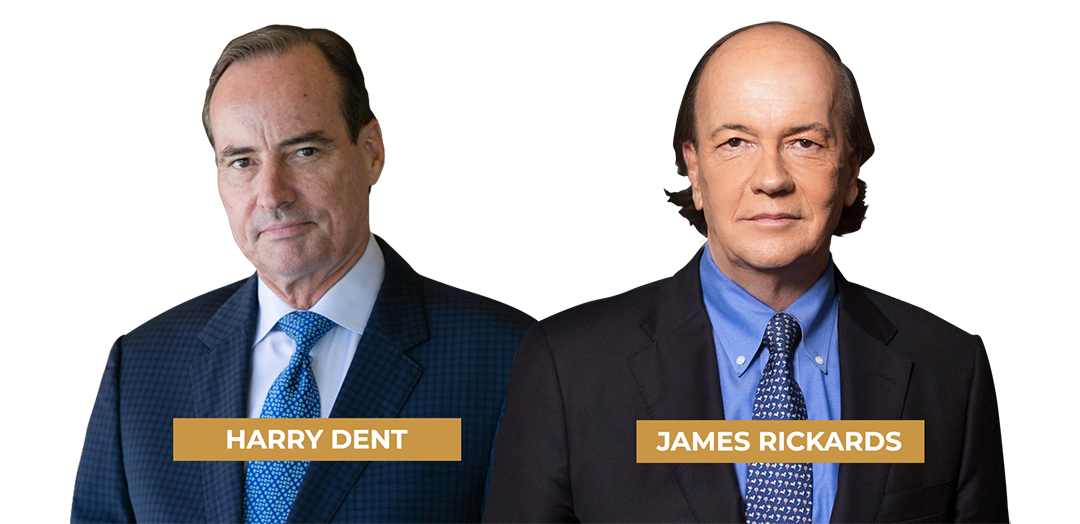

Harry Dent and James Rickards are gearing up to meet face to face in a live debate to discuss in depth the future of gold and how to make more informed investment decisions in 2021 and beyond.

Harry Dent is a bestselling author and renowned economic forecaster.Dent predicted Japan’s 1989 economic collapse, the dotcom bubble AND the US subprime bust…all well ahead of time.His forecasts are legendary.Particularly in the late 1980s, when he predicted the coming Japanese slowdown.Probably his most famous book was The Great Boom Ahead, published in 1993, where he was virtually on his own in predicting the unanticipated ‘boom’ of the 1990s.

James G. Rickards is an American lawyer, economist, investment banker, speaker, media commentator, and New York Times bestselling author on matters of finance and precious metals. He is the author of Currency Wars: The Making of the Next Global Crisis, The New Case for Gold and “The New Great Depression, Winners and Losers in Post-Pandemic World”. He is known internationally for predicting the worst economic crisis in history.Many remember the global financial crisis of 2008 and how it all started. What people might not know is that James Rickards predicted all that happened back then.James Rickards was a national security advisor for the Pentagon and the CIA. He also advised members of President Trump’s cabinet, and gave the Federal Reserve a hand when America was about to enter a $1.3 trillion financial crisis, back in 1990.

Both Harry and James are not so optimistic about the future.

They expect a depression, seeing many factories closed, and economic disasters caused by the lockdowns. James believes the economy will fall like a domino.But both these men adamantly disagree on the future of gold.Harry Dent is calling for gold to see its final rally to $2,200 an ounce this year before falling to multi-year lows. After 2022, the new lows should present a new buying opportunity. “From 2022 on, I’d be buying gold hand in fist, it’s going to hold up better than most commodities. I’m expecting gold to go up…to $2,200 an ounce and then crash back down to its 2015 lows, around $1,000.”Dent also argues that gold has no currency value. He challenges people to take a gold coin to a grocery store and try to buy something with it. Since gold doesn’t circulate throughout the economy, he believes this to be one reason its price will crash.James Rickards believes you soon MIGHT NOT BE ABLE TO BUY GOLD AT ANY PRICE!James Rickards believes Gold will reach $10,000 an ounce.James Rickards comes to that conclusion in a very scientific manner. It’s really just about math.

LIVE Virtual Event

ONLINE EVENTYou will be sent an email with the access link after you register!

Thursday, February 25th 11am AEDT (Sydney)

Wednesday, February 24th 7pm EST (New York)

Time left until registration closes:

Shortcode could not be rendered

Obviously they can’t both be right this time.

This is why we’ve locked Harry in to do a face off against the man who staunchly disagrees with him.We don’t expect either man will change the other’s mind. But they might well change your views.Backing the right forecast, after all, could make a tremendous difference to your wealth.

Harry and James will answer your most burning questions, backed with an impressive array of evidence:

- Should you buy gold or wait?

- Is there enough gold in the world?

- Will gold prices go up or down?

- How does inflation affect gold?

- Is gold a safe investment in the coming months and years?

- What affects the price of gold?

- Is gold really an inflation hedge?

- Should gold be a long term or short term investment?

- When is the best time to buy and sell gold?

- What is the best way to invest in gold?

- Are there risks when it comes to investing in gold?

Plus, Harry and James will share their considered opinions on:

- Bitcoin vs. Gold and the future of money

- The actual math behind how James Rickards comes to his 10k gold price

- The safest asset in the world

- What threatens the dollar, and can make gold prices soar way faster

- The mistake that should be avoided when investing in gold

Who will make the most convincing case?What common ground do they share? One of the key things they agree on could make you reshape your strategy dramatically over the next 6 months.And who, in the fullness of time, will be proven right?Secure your virtual seat here to find out.This debate will get really heated… Don’t miss this rousing and very polarizing discussion and go beyond the mainstream media to make more informed decisions as an investor.

LIVE Virtual Event

ONLINE EVENTYou will be sent an email with the access link after you register!

Thursday, February 25th 11am AEDT (Sydney)

Wednesday, February 24th 7pm EST (New York)

Time left until registration closes:

Shortcode could not be rendered

GOKO GROUP Pty Ltd – Lot 121 – 18 Fern Street Surfers Paradise QLD 4217 Australia – ABN – 256 279 702 36 | Privacy Policy | Terms & Conditions